What is Earnometer Nifty: A complete Guide

In this blog, you will be able to know what the use of Earnometer Nifty and how can it help you get to know what is the true use of Earnometer Nifty Bank.

Overall, Earnometer is a website and Earnometer Nifty is part where that website is used to tell everything you need to know about the price of the Nifty and it also provides you with trend analysis reports for the Indian stock market. Mainly these reports are used to cover shares, commodities, currencies, and derivatives.

Barometer also provides trend analysis for Nifty, which has an index of the top 50 companies which is used on the National Stock Exchange (NSE). If a company wants to be listed on the Nifty, then it should be listed on the NSE too and its stocks must be available for trading in the NSE's Futures and Options segment.

Adjusted float and market capitalization weighted method which is used in the NIFTY 50 index. The index level is used to represent the aggregate market value of the stocks in the index mostly during a specific base period.

Earnometer Nifty Bank

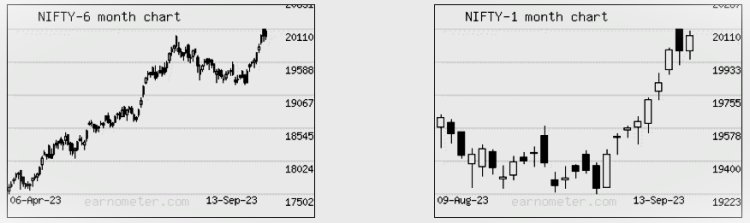

NIFTY FUTURES-CMP(20125.15) is currently in the BULL trend. The trend was very strong yesterday which was going in the BULL LOW VOLATILITY in the Sep series Nifty future is used to add 0.79 lakh position in Open Interest and the main thing is that this account is used to be around 0.78% of the Total Open Interest in Sep series. In recent times Nifty Sep series is trading at a 55.15 Rupees premium to underlying.

In cumulative derivative for all the series contracts Nifty future has added 1.8 laks which used to be in an open interest position and this accounts used to be at 1.57% out of the overall total open interest in all series and also trading in average premium of 158.18 Rs to Underlying. If you don't know then we would like you to know that open interest is also increasing with the trend and it also used to be premium of share is also increasing indicating bull move.

In options activity earnometer nifty bank is used to confined to lower puts even though the put/call ratio is high at the current price strike we can also say that activity is tilted to the call side and the ratio is still very strong and the nifty call and put options is used to trade at a discount price which is expecting rangebound in between 20100 and 20000 and most importantly yesterday nifty put option has added 2348.83 lakh position and earnometer nifty call option added 1873.6 lakh position in open interest mainly on a cumulative basis and Moneyview wise Nifty put option has recently added Rs. 212.29 crores mainly in value and Nifty call option has shed Rs. -46.38 crore in value on a cumulative basis.

Conclusion

We are very fortunate to tell you that we are introducing a new course that will be very beneficiary for any type of trader and that's why if you are a potential trader and thinking about learning stock trading from the best stock trading service provider and in our educational course you will be able to learn from three types of course in which you will be able to learn option, technical part and fundamental course too which you will be able to learn from the best faculty in the stock market and most importantly experience is a very crucial part of stock trading and we are fortunate enough to get a faculty who has an experience of more than 10+ years.

What's Your Reaction?